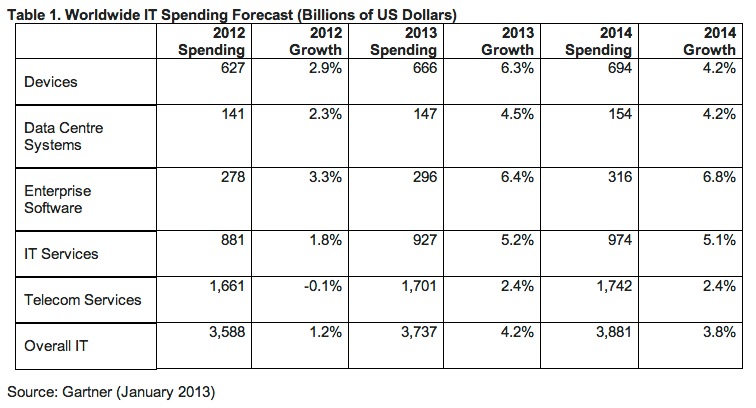

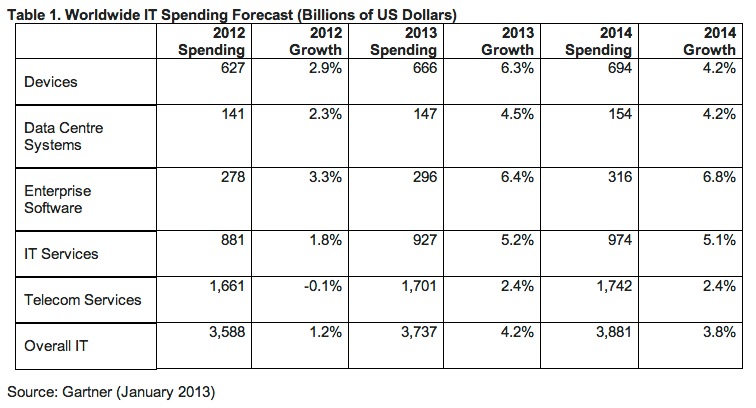

Analyst Gartner has increased its forecast for worldwide IT spending in 2013, revising its Q3 2012 figure up from 3.8 per cent growth to 4.2 per cent higher than last year’s figure. The analyst is now forecasting that worldwide IT spending will hit $3.7 trillion in 2013. Much of this spending increase is down to projected gains in the value of foreign currencies versus the dollar, said Gartner, noting that when measured in “constant dollars”, 2013 spending growth is predicted to be 3.9 per cent.

“Uncertainties surrounding prospects for an upturn in global economic growth are the major retardants to IT growth,” said Richard Gordon, managing vice president at Gartner, in a statement. “This uncertainty has caused the pessimistic business and consumer sentiment throughout the world. However, much of this uncertainty is nearing resolution, and as it does, we look for accelerated spending growth in 2013 compared to 2012.”

Gartner’s forecast for worldwide devices spending — which includes PCs, tablets, mobile phones and printers — is expected to reach $666 billion in 2013, up 6.3 per cent from 2012. Despite this rise, the forecast is a “significant reduction” on Gartner’s previous 2013 outlook forecast of $706 billion in worldwide devices and 7.9 per cent growth. The analyst noted that its long-term forecast for worldwide spending on devices has been reduced as well, with “growth from 2012 through 2016 now expected to average 4.5 per cent annually in current U.S. dollars (down from 6.4 per cent) and 5.1 per cent annually in constant dollars (down from 7.4 per cent)”.

Gartner said these reductions reflect a “sharp reduction” in the forecast growth in spending on PCs and tablets that’s only partially offset by “marginal increases” in forecast growth in spending on mobile phones and printers. The analyst also noted that increased competition from cheaper Android powered tablets has contributed to the reduction in its devices spending forecast.

“The tablet market has seen greater price competition from Android devices as well as smaller, low-priced devices in emerging markets,” Gordon noted in a statement. “It is ultimately this shift toward relatively lower-priced tablets that lowers our average selling prices forecast for 2012 through 2016, which in turn is responsible for slowing device spending growth in general, and PC and tablet spending growth in particular.”

Enterprise software has the highest projected growth in IT spending for 2013, according to Gartner, which is forecasting growth of 6.4 per cent and 2013 spending of $296 billion.

Forrester has also put out its global IT spending forecast for 2013. The analyst is forecasting 5.4 percent growth (local currencies) and describes this year as a transition year as much of the economic instability currently impacting markets recedes — “such as the fiscal cliff, the European recession, the leadership transition in China”. The analyst anticipates IT spending increasing further in 2014, and is projecting growth of 6.7 percent globally for next year.

“We think that the global tech market will do a bit better in 2013 than it did in 2012, and will do even better in 2014,” blogs Forrester analyst Andrew Bartels. Growth in 2014 is likely to be fuelled by pent-up demand for technologies such as “mobility, cloud computing and smart computing” as the squeeze on IT budgets comes to an end, says Forrester.

Regional growth in IT spending will vary this year with Europe experiencing minimal growth (0.8 per cent), but other geographies including the U.S. generating higher growth. Forrester is projecting IT spending will grow by 7.5 per cent in the U.S., and by 4 per cent in Asia Pacific.

Computer hardware will continue to stall this year, according to Forrester, which notes that ”PC vendors had a lousy 2012″, with zero growth overall, while server vendors did even worse, with a 4 per cent decline. The analyst sees no recovery for these categories this year, as well as flat Wintel PC sales, declining storage purchases and peripherals slowing to 3 per cent growth.

The 4 per cent overall growth Forrester is projecting for PCs this year is misleading as the analyst notes this is “mostly due” to tablets — which it counts in the broader PC category. Apple also continues to buck the trend of declining PC sales: Forrester estimates Apple will sell $7 billion of Macs and $11 billion of iPads to the corporate market in 2013, and $8 billion in Macs and $13 billion of iPads in 2014.

Global corporate spending on Wintel PCs and tablets was down by 4 per cent in 2012, according to Forrester, and is expected to be flat in 2013 as firms slowly replace their old Windows PCs with Windows 8 devices. There’s better news for Redmond next year as Forrester anticipates increased PC demand and improved Windows 8 devices in 2014 will lead to a strong 8 per cent increase of these products. However that growth will still be less than the double-digit growth it’s projecting for Linux, Android, and Apple products.

“Uncertainties surrounding prospects for an upturn in global economic growth are the major retardants to IT growth,” said Richard Gordon, managing vice president at Gartner, in a statement. “This uncertainty has caused the pessimistic business and consumer sentiment throughout the world. However, much of this uncertainty is nearing resolution, and as it does, we look for accelerated spending growth in 2013 compared to 2012.”

Gartner’s forecast for worldwide devices spending — which includes PCs, tablets, mobile phones and printers — is expected to reach $666 billion in 2013, up 6.3 per cent from 2012. Despite this rise, the forecast is a “significant reduction” on Gartner’s previous 2013 outlook forecast of $706 billion in worldwide devices and 7.9 per cent growth. The analyst noted that its long-term forecast for worldwide spending on devices has been reduced as well, with “growth from 2012 through 2016 now expected to average 4.5 per cent annually in current U.S. dollars (down from 6.4 per cent) and 5.1 per cent annually in constant dollars (down from 7.4 per cent)”.

Gartner said these reductions reflect a “sharp reduction” in the forecast growth in spending on PCs and tablets that’s only partially offset by “marginal increases” in forecast growth in spending on mobile phones and printers. The analyst also noted that increased competition from cheaper Android powered tablets has contributed to the reduction in its devices spending forecast.

“The tablet market has seen greater price competition from Android devices as well as smaller, low-priced devices in emerging markets,” Gordon noted in a statement. “It is ultimately this shift toward relatively lower-priced tablets that lowers our average selling prices forecast for 2012 through 2016, which in turn is responsible for slowing device spending growth in general, and PC and tablet spending growth in particular.”

Enterprise software has the highest projected growth in IT spending for 2013, according to Gartner, which is forecasting growth of 6.4 per cent and 2013 spending of $296 billion.

Forrester has also put out its global IT spending forecast for 2013. The analyst is forecasting 5.4 percent growth (local currencies) and describes this year as a transition year as much of the economic instability currently impacting markets recedes — “such as the fiscal cliff, the European recession, the leadership transition in China”. The analyst anticipates IT spending increasing further in 2014, and is projecting growth of 6.7 percent globally for next year.

“We think that the global tech market will do a bit better in 2013 than it did in 2012, and will do even better in 2014,” blogs Forrester analyst Andrew Bartels. Growth in 2014 is likely to be fuelled by pent-up demand for technologies such as “mobility, cloud computing and smart computing” as the squeeze on IT budgets comes to an end, says Forrester.

Regional growth in IT spending will vary this year with Europe experiencing minimal growth (0.8 per cent), but other geographies including the U.S. generating higher growth. Forrester is projecting IT spending will grow by 7.5 per cent in the U.S., and by 4 per cent in Asia Pacific.

Computer hardware will continue to stall this year, according to Forrester, which notes that ”PC vendors had a lousy 2012″, with zero growth overall, while server vendors did even worse, with a 4 per cent decline. The analyst sees no recovery for these categories this year, as well as flat Wintel PC sales, declining storage purchases and peripherals slowing to 3 per cent growth.

The 4 per cent overall growth Forrester is projecting for PCs this year is misleading as the analyst notes this is “mostly due” to tablets — which it counts in the broader PC category. Apple also continues to buck the trend of declining PC sales: Forrester estimates Apple will sell $7 billion of Macs and $11 billion of iPads to the corporate market in 2013, and $8 billion in Macs and $13 billion of iPads in 2014.

Global corporate spending on Wintel PCs and tablets was down by 4 per cent in 2012, according to Forrester, and is expected to be flat in 2013 as firms slowly replace their old Windows PCs with Windows 8 devices. There’s better news for Redmond next year as Forrester anticipates increased PC demand and improved Windows 8 devices in 2014 will lead to a strong 8 per cent increase of these products. However that growth will still be less than the double-digit growth it’s projecting for Linux, Android, and Apple products.